does oklahoma have an estate or inheritance tax

Attorneys with you every step of the way. Whats the difference between an estate tax and an inheritance tax.

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template

You generally wont owe tax on money you inherit but other inherited assetssuch as securities retirement accounts or real estatecan have tax implications.

. If your probate case does not pay then you owe us nothing. Maryland is the only state to impose both. See all personal services.

Compare state estate tax rates and state inheritance tax rates below. File for divorce in. During this time the executor will also file the final tax return for the estate and pay any taxes owed.

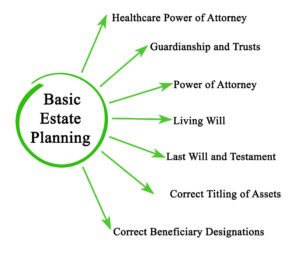

Learn the specific estate planning documents you need to protect yourself and your loved ones. Your average tax rate is 1198 and your marginal tax rate is 22. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

Unlike an estate tax beneficiaries pay the inheritance tax and it is. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. You can use the advance for anything you need and we take all the risk.

This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you. Dont Assume Youll Get It. This marginal tax rate means that.

And should you be concerned about the implications of either on your estate plan. All six states exempt spouses and some fully or partially exempt immediate relatives. This includes federal and state income taxes as well as any federal estate taxes and state estate taxes.

Since a transfer on death account is not a trust it is part of the decedents estate. Beneficiaries and heirs will pay any federal or state impose inheritance tax once their inheritance is disbursed. Twelve states and Washington DC.

There is no obligation. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Marylandwhich also has an estate taximposes the lowest top rate at 10 percent.

An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate. Our network attorneys have an average customer rating of 48 out of 5 stars. May 02 2022.

Impose estate taxes and six impose inheritance taxes. Your credit history does not matter and there are no hidden fees. It does not avoid or minimize estate taxes.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Wills In Oklahoma Infographic Oklahoma Estate Planning Attorneys

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Oklahoma Estate Tax Everything You Need To Know Smartasset

Oklahoma Estate Tax Everything You Need To Know Smartasset

Oklahoma Estate Tax Everything You Need To Know Smartasset

Executor Duties In Oklahoma Probate Tulsa Probate Lawyer Kania Law

Do I Need To Pay Inheritance Taxes Postic Bates P C

Estate Planning Tulsa Tax Preparation Oklahoma Ok

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Second Marriage Estate Planning Tulsa Estate Planning Kania Law

Estate And Inheritance Taxes In Oklahoma Tax Strategies Planning

Asset Protection In Oklahoma Estate Planning Tulsa Wills Trust Lawyer

Oklahoma Inheritance Laws What You Should Know Smartasset

Do I Need To Pay Inheritance Taxes Postic Bates P C

The Simplified Probate Procedure Oklahoma Probate Advance

Do I Need To Pay Inheritance Taxes Postic Bates P C

State Taxes On Inherited Wealth Center On Budget And Policy Priorities