irvine income tax rate

Californias top income tax rate 133 on taxable incomes over 1 million is by far the nations highest and when added to the top federal rate of 37 pushes the overall bite to more than 50. Proof of income can include a salary agreement or contract from your employer that states your hourly rate or annual income.

Top Tax Rate On Personal Income Would Be Highest In Oecd Under New Build Back Better Framework Income Tax Rate Income Tax

The most salient proposals however presuppose that the estate tax will remain at 2009 levels that is with a lifetime exemption amount of 35 million and maximum tax rate of 45.

. Founded in 1965 UCI is the youngest member of the prestigious Association of American Universities and is ranked among the nations top 10 public universities by US. Failed verification Although largely suburban it is the second most densely. The property tax rate in the county is 078.

However the same goes for tax returns as a W-2. It contains 5 bedrooms and 3 bathrooms. William Gale Brookings Institution.

Another option being weighed up by the Foreign Secretary is a cut to income tax the paper said with proposals from allies including increasing the level above which people start paying the levy. Morningstar rated the Lord Abbett Short Duration Income Fund class A share 3 4 and 5 stars among 550 487 and 335 Short-Term Bond Funds for the overall rating and the 3 5 and 10 year periods ended 8312022 respectively. Income verification A landlord will also want to know that the rent will not consume too much of your income.

Your lender might ask for a profit and loss balance if youre self-employed. Proposition 30 raised the statewide sales tax rate from 725 to 750 effective January 1 2013. The trustee must make the election to treat a trust as an ESBT within the two-month-and-16-day period beginning on.

By Sid Siddiqui Irvine Calif. Your most recent tax return. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

News World ReportThe campus has produced five Nobel laureates and is known for its academic achievement premier research innovation and anteater mascot. States and Washington DC. Many local municipalities impose additional sales taxes on top of the standard statewide rate.

Nowadays drones are definitely one of trending products to sell in 2022. Trending products to sell online in 2022. About a half-dozen bills in Congress address in various ways the repeal of the estate tax scheduled for 2010 and its resurrection the following year under 2001 law.

Your lender will likely need your entire tax return when you request a modification. It offers a fixed interest rate and down. Tax-exempt mortgage revenue bonds.

The IRS 1040 Individual Income Tax Return is very comprehensive and doesnt overstate the applicants income. The UC Irvine branch of the California Census Research Data Center is a partnership between the School of Social Sciences and the US. The on-campus site allows UCI researchers access to confidential Census data that is central to high quality research in economics sociology health services public health transportation law.

Whats more as a rule you can find some models of drones that dont cost a lot. The lender is based in Irvine California and is available to borrowers in more than 35 states. Standard analysis of the corporate income tax assumes shareholders bear the burden of taxes.

State transfer tax in California works out at 055 for every 500 of the propertys value while rates for county taxes will vary greatly depending on the location. The definition of a dependent has changed from a child under the age of 18 to include a child 18 years or over who lives with the applicants and is totally financially reliant. Tax returns are a great way to check for proof of income because they show unearned income as well as overall income history.

They earn dividends on foreign currency loan interest collected services and interest from government securities. The Rent Zestimate for this home is 1716mo which has increased by 17mo in the last 30. The Role of Rent Sharing with Samuel Thorpe Brookings Institution at NYU today as part of its Tax Policy and Public Finance Colloquium hosted by Daniel Shaviro.

Others in the Truss camp have suggested raising the tipping point for the higher rate of 40 and cutting the basic rate below 20 it added. H today reported second quarter 2022 financial resultsNet income attributable to Hyatt was 206 million or 185 per diluted share in the second quarter of 2022 compared to a net loss attributable to Hyatt of 9 million or 008 per diluted share in the second quarter of 2021. The Zestimate for this house is 155700 which has decreased by 14200 in the last 30 days.

Orange County is located in the Los Angeles metropolitan area in Southern CaliforniaAs of the 2020 census the population was 3186989 making it the third-most populous county in California the sixth most populous in the US and more populous than 27 US. It may be hard for tenants to find and it may not. CHICAGO August 9 2022 - Hyatt Hotels Corporation Hyatt or the Company NYSE.

Applicants who are employed submit pay stubs to confirm employment and current pay. One shortcoming of an ESBT is that its S corporation portion is subject to the highest rate of income tax on ordinary income currently 396. So they typically target a moderate postive rate of consumer price inflation around 2.

Download Fiscal Fact No. Sales Tax Rates in Major US Cities Sales taxes in the United States are levied not only by state governments but also by city county Native American and special district governments. The Federal Reserve monitors and generates income from several entities.

Income limits for the program vary by city. The gross shaded rental income less investment property cost is added to the taxable gross income to determine the marginal tax rate and calculate net income. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

Home page for the University of California Irvine. 1305 Walton Rd Irvine KY is a single family home that contains 2654 sq ft and was built in 2004. Low-income housing tax credits.

If you live in Los Angeles county for example youll end up paying double compared to residents of other counties with a tax rate of 110 per 1000 of property value. If you are an independent contractor or otherwise self-employed you. Above these income thresholds new marginal tax rates were created by the passage of Prop 30.

The reason why its near full retail rate credit instead of full retail rate credit for the electricity you send back to the grid is because California recently amended their NEM to NEM 20. S Corporation Income Taxation. Zestimate Home Value.

W2s and recent tax returns are alternatives when pay stubs are not available. Google Scholar presents Rethinking the Corporate Income Tax. Some kind of local state or federal grants and loans.

In many cases these local sales taxes can have a profound impact on the total rate that consumers see. Thats why if you deal with reselling electronics consider dropshipping drones as one of the most passion-driven niches for your ecommerce business.

15 Self Employment Tax Deductions In 2022 Nerdwallet Capital Gains Tax Income Tax Brackets Income Tax Return

Understanding California S Property Taxes

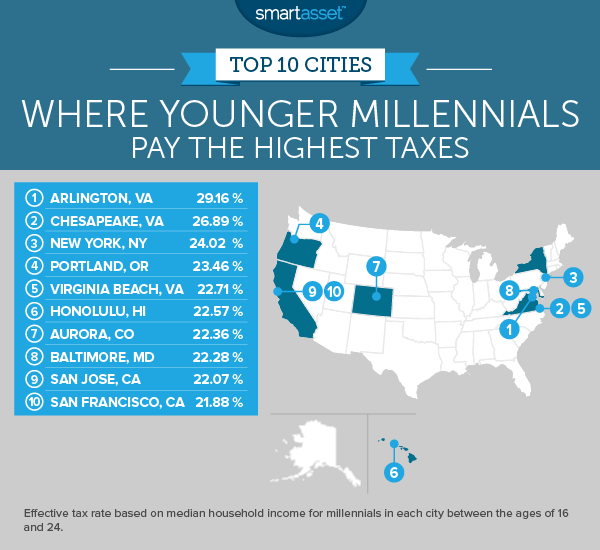

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Orange County Ca Property Tax Calculator Smartasset

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Why Households Need 300 000 To Live A Middle Class Lifestyle

Why Households Need 300 000 To Live A Middle Class Lifestyle

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

Pin On Tax Relief And Legal Updates

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

Self Employed People Can Get A Great Home Loan Home Loans Mortgage Loans Loan

We Specialize In Non Qm Loans And Has Great Solutions For People That Have An Individual Tax Identification Number It Home Ownership Home Buying The Borrowers

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax